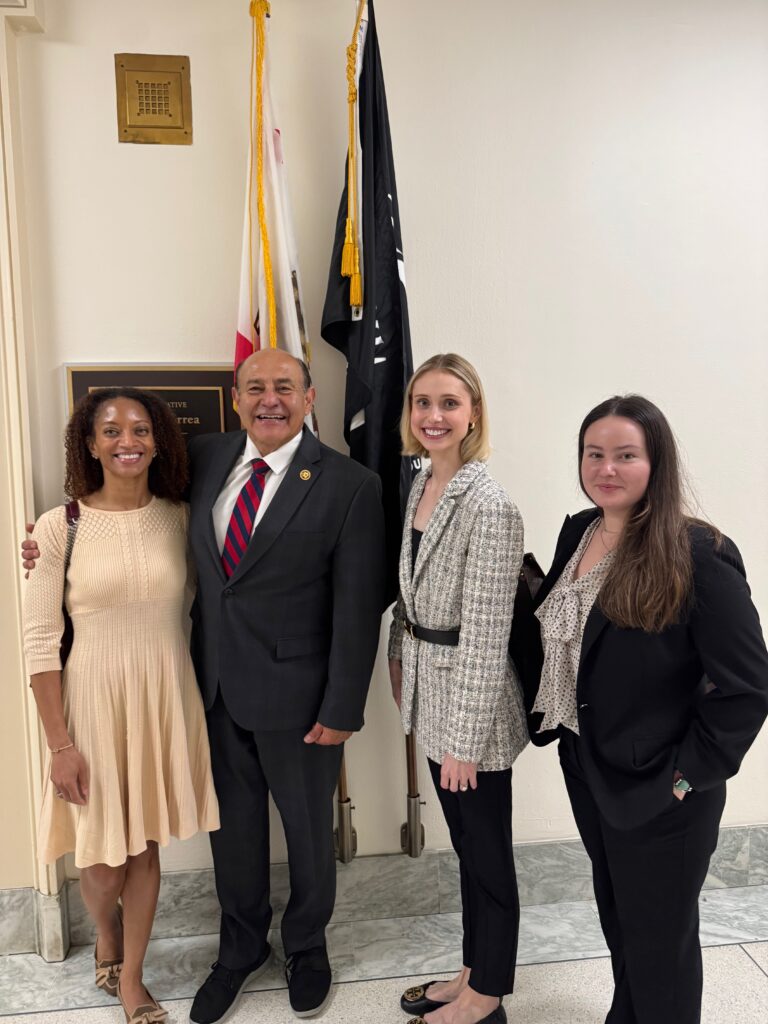

PULSE partners recently made their way to Capitol Hill to emphasize how mergers and acquisitions (M&A) are critical to advancing new breakthroughs to patients.

Industry leaders from Biocom California, BioNJ, the Health Care Institute of New Jersey and Maryland Tech Council met with members of Congress and their staff to underscore the need to support pro-competitive life sciences M&A and continue to preserve America’s global leadership in life sciences innovation. With new treatments and cures in development across thousands of companies and disease areas, M&A is a critical driver of progress for patients, local communities and our nation’s economy.

Key areas of focus included:

1. How M&A plays a unique and fundamental role in the life sciences industry

The U.S. life sciences sector is uniquely competitive, made up of more than 2,300 companies that employ millions of Americans across every U.S. state. Competition policies that are unique to this dynamic industry have helped fuel decades of innovation and constant competition to advance new treatments and cures. Across the country, M&A has been a cornerstone in helping companies bring these new breakthroughs from the lab to the patient.

2. How life science companies of all sizes engage in M&A to bring new treatments and cures to patients

Often in the life sciences industry, no one company can take a treatment from discovery to market alone. M&A allows life sciences companies of all sizes — 80% of which operate without a profit — to collaborate, share risk and bring together the expertise and resources needed to advance new therapies. M&A also often serves as an anticipated exit point for investors, helping companies attract the funding they need to innovate. By allowing companies to specialize in what they do best, and partner to “pass-the-baton” and unlock complementary resources and expertise, M&A helps keep America at the forefront of developing and delivering new medicines to patients.

3. Why policymakers must support the fundamental role of M&A in America’s life sciences industry

Recent changes to the Federal Trade Commission (FTC)’s Hart-Scott-Rodino premerger notification rule and the FTC and Department of Justice’s 2023 Merger Guidelines have increased the time, cost and uncertainty for life sciences companies engaging in pro-competitive life sciences M&A. PULSE urged lawmakers to work with the Agencies to revisit these policies and ensure that innovation-driving deals are not caught in unnecessary red tape.

To read more on the insights PULSE shared, and the fundamental role of M&A in supporting America’s global leadership in life sciences innovation and competition, click here.