Blog Posts

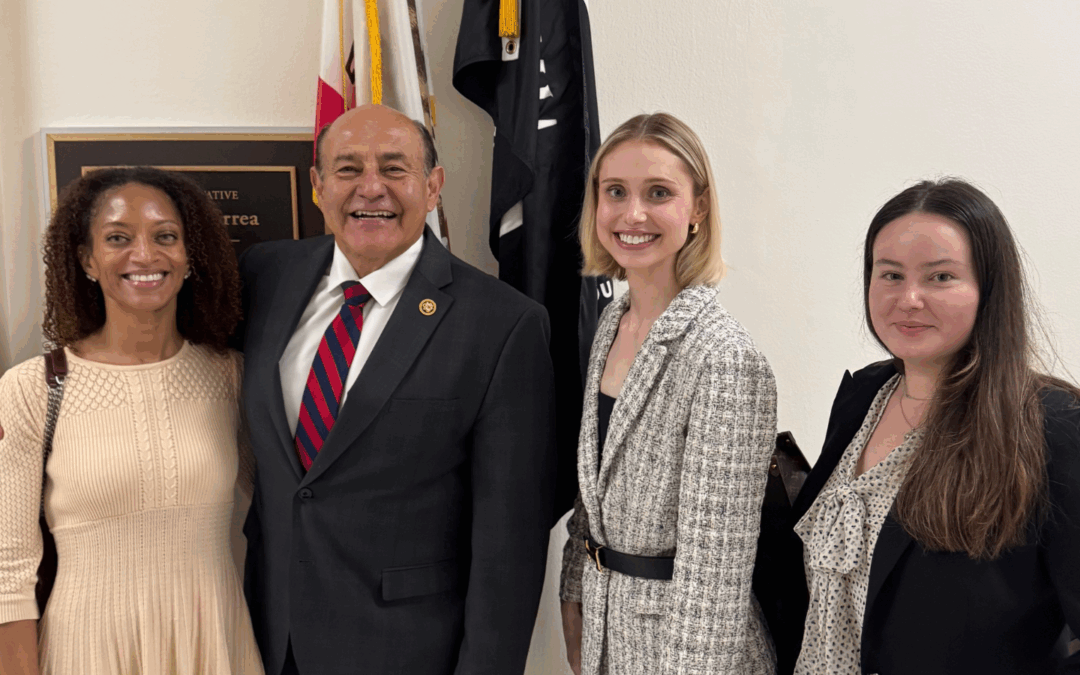

PULSE Partners Return to Capitol Hill to Advocate for Pro-Competitive Life Sciences M&A

As part of PULSE’s efforts to engage policymakers around the unique and fundamental role of mergers and acquisitions (M&A) within the life sciences industry, PULSE partners made their way to Capitol Hill to emphasize how these critical partnerships are advancing new medicines to patients.

Life Sciences M&A Fuels Domestic Manufacturing

The U.S. life sciences industry is a key driver of economic growth and domestic manufacturing. American pharmaceutical manufacturers employ an estimated 291,000 employees, and for every one job in the pharmaceutical industry, four jobs are created in supporting...

M&A Fuels Innovation and Competition in Obesity Treatment

As the need for more effective and accessible obesity medicines grows, mergers and acquisitions (M&A) have emerged as a key strategy for life science companies of all sizes to accelerate innovation and competition to bring new treatment options to patients.

From Innovation to Economic Growth: The Role of M&A in Local Communities

M&A in America’s life sciences industry not only plays a critical role in bringing new breakthroughs to patients, but also strengthens state economies across the country. Life sciences M&A plays a pivotal role in fueling innovation, creating jobs and attracting long-term investment to local communities.

New PULSE Resource: Research Article – The Impact of Pharmaceutical M&A on Innovation

A new PULSE resource includes key insights from economists at Cornerstone Research on the the unique and fundamental role of mergers and acquisitions (M&A) in driving innovation across America’s biopharmaceutical industry.

Life Sciences M&A: A Vital Catalyst for Investment and Innovation

With more than 80% of life sciences companies operating without a profit, external investment—including from venture capital (VC)—is often critical to bringing a new treatment or cure to market. As macroeconomic headwinds have made investors increasingly cautious about investing in early-stage companies, mergers and acquisitions (M&A) play a crucial role in sustaining innovation across the American life sciences ecosystem.

New PULSE Resource: Life Sciences Innovations Advanced by M&A

For decades, mergers and acquisitions (M&A) have fueled the development and delivery of breakthrough treatments for complex diseases with a high unmet need. A new resource from the Partnership for the U.S. Life Science Ecosystem (PULSE) spotlights this unique and...

New PULSE Resources: M&A Fuels Innovation, Competition in America’s Life Sciences Industry

New resources from the Partnership for the U.S. Life Science Ecosystem (PULSE) highlight the unique and fundamental role of mergers and acquisitions (M&A) in America’s life sciences industry. Life sciences M&A represents a critical pathway for companies of all...

Maryland Daily Record Op-Ed: “Misguided Antitrust Policies Jeopardize Maryland Life Sciences Industry”

In a recent op-ed for The Maryland Daily Record, Kelly Schulz, CEO of PULSE Partner Maryland Tech Council, discusses discusses how federal policy against mergers and acquisitions (M&A) could undermine Maryland’s status as an innovation leader in the life sciences.

Innovations Advanced by M&A: A Novel Treatment for Atopic Dermatitis

For many early-stage life sciences companies, mergers and acquisitions (M&A) represent a critical path. M&A helps companies unlock the complementary resources and expertise that help advance a new therapy from the lab to patients at scale. For example, Dermira’s acquisition by Eli Lilly & Co. helped bring Ebglyss, a novel monoclonal antibody treatment, to patients living with moderate-to-severe atopic dermatitis (AD).